With US housing slump, Canadian lumber industry has faced serious challenges since more than 80% of its output were sent south of the broader. Recent Media has presented an optimistic future solution to Canadian lumber industry. China turned to be the hope. The question is whether China will replace US to be the major importer of Canadian lumber products.

China's lumber import has been steadily growing during the last decades from demand of both re-export of processed products and domestic consumption. Most of imports are from South Asia and Russia while Canada has only very limited share of the market.

According to latest data release from China Custom, for the first half year of 2009, the total volume of importing logs is 133 million cubic meter which is 18.7% less than the same period last year. The total price has been decreased to US$136 per cubic meter which is 20.6% less. The total amount is 35.5% less. The results of the data shows:

First, The total amount of import has been decreased dramatically while price has fluctuated a little. In January, import log is 1,271,000 cubic meter which is the lowest since 2008. In April, the amount reached 2,920,000 cubic meter. However, the amount started to decrease after that till June. Price in April is 126.5 per cubic meter. After that price starts to increase a little each month till $136.8 per cubic meter.

Second, small trades near boarders dominate half of all trades. Boarder trade imports 64 million cubic meter which is 30.7% less than the same period last year. General import channel imports 63 million cubic meter which is 0.6% more than last year. In addition, importing log which is used for re-export is 4 million cubic meter which is 35.9% less than the same period last year.

Third, private companies export 70% of final wood products. Total import from private sector is 90 million cubic meter which is 23.2% less than the same period last year. State-owned companies imported 35 million cubic meter logs which is 0.7% more. Foreign companies in China imported 4 million cubic meter which is 41.5% less.

Fourth,the majority of import is from Russia and imports from New Zealand has been increased. Total log from Russia for the first half year is 77 million cubic meter which is 27.6% less than the same period last year. It is 57.7% of total importing log. Imports from New Zealand is 19 million cubic meter which is 14.1% more.

The majority of importing logs are used for re-export. The slowing demand for furniture and building materials, floors etc. has been the main reason for the slowdown of import. Many Chinese wood processing factories has been closed. 70% to 80% of engineered wood processing factories are in the state of running half capacity or stopped production completely.

While on the other hand, major suppliers to Chinese market has implemented policies that limit export of logs. Russia has increased tax to 25% and European union has implemented policies to stop illegal logging. All these efforts has increased the cost of raw material and discouraged Chinese wood processors from accumulating inventories.

The major demand from this period came from the domestic consumption. The internal demand has been boosted with the help of stimulus package both for Infrastructure building and individual consumption. However, the structure of the whole wood processing industry is still more than 70% export oriented. It takes time for Chinese companies to restructure its focus and reduce its capacity.

China's real estate has been started to bounce back during the recent months thanks to the large amount of stimulus efforts from both the central and local governments. Huge stimulus spending has been successful in stabilizing downward spiral of demand. The question is whether the real estate sector can keep its momentum to recovery or the new recovery shoots will sunk in the near future. For my view, the stimulus money has inflationary impact on the housing sector. China's stimulus efforts has been mainly focused on consumption side from both individual and state level. From individual level, consumption coupon, long holidays, tougher labor laws, employment assistance, re-education etc. have boosted demand. From state level, social security, infrastructure investment, and financial assistance to new technology and plants and inflow of oversea Chinese professionals have created new picture of future development for China. In general, most of money has been spend to strength internal demand while most troubled exported-oriented firms are encouraged to close or merge with other healthier firms. The output capacity of lumber export products has been dramatically reduced for the first half of the year.

As Chinese leaders repeatedly stressed to the rest of the world, China's stimulus efforts can't save the world out of the recession. China can only do that much to save itself. It did so. The puzzle for Canadian lumber industry is how large will be the domestic demand for lumber and logs comparing to the export sector if the export sector does not recover that soon. Not much, perhaps 20% to 30%. It will be a tough market to compete for the domestic pie. Will it be worth to pursue it? Yes! China has relatively healthy and strong financial sector and the balance sheet of the government, companies and individuals are much healthier than some of the most affluent countries. While US has been borrowing money to spend, China spent modestly in the past to keep its house in order. The potential of this domestic market for lumber and logs are worthwhile to pursue.

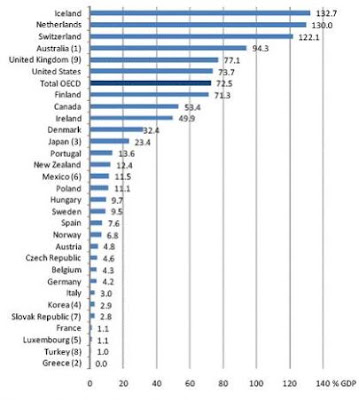

We are the very early state of structural global recession. To fight deflation, global leaders has poured trillions of dollars into the system. Detailed analysis of stimulus plan is shown by Brooking Institute. Despite the huge amount of money spent by each government, the efforts are still far less than needed to combat the severity of the crisis comparing to the total amount of GDP. Lumber demand from US will not recover to the previous level any time soon due to heavy indebtedness from both individual, company and state level.

The total demand of lumber will not increase anytime soon while price will increase slowly thanks to the reduced capacity in the long run. It will be good news for the few survival lumber and forestry firms, not for those who don't have the financial resources to weather the difficult times.

Doing business as usual may not work at this global recession. Bold actions and courage are needed. For most small lumber and forest firms, one of the solution is to form strategic partnership with reputable and financially healthy Chinese firms and developers. Through this partnership, small Canadian firms can have access to existing sales and distribution channel of the wood industry in China while obtaining financial support from the one of the few cash rich Chinese firms. The reward is that your firm and employees will go through the difficult time and wait for the next economic boom to reap all the profits.

For more information, please email Ying Dwyer at inquiry@chineseservices.ca

About Ying Dwyer Chinese Services

Ying Dwyer Chinese Services ( www.chineseservices.ca ) comprises China market and

business consulting, research and Chinese translation services for Canadian companies and government clients.

Please Use Zerohedge.org

14 years ago