Saturday, October 10, 2009

Will China save the Canadian Lumber Industry?

China's lumber import has been steadily growing during the last decades from demand of both re-export of processed products and domestic consumption. Most of imports are from South Asia and Russia while Canada has only very limited share of the market.

According to latest data release from China Custom, for the first half year of 2009, the total volume of importing logs is 133 million cubic meter which is 18.7% less than the same period last year. The total price has been decreased to US$136 per cubic meter which is 20.6% less. The total amount is 35.5% less. The results of the data shows:

First, The total amount of import has been decreased dramatically while price has fluctuated a little. In January, import log is 1,271,000 cubic meter which is the lowest since 2008. In April, the amount reached 2,920,000 cubic meter. However, the amount started to decrease after that till June. Price in April is 126.5 per cubic meter. After that price starts to increase a little each month till $136.8 per cubic meter.

Second, small trades near boarders dominate half of all trades. Boarder trade imports 64 million cubic meter which is 30.7% less than the same period last year. General import channel imports 63 million cubic meter which is 0.6% more than last year. In addition, importing log which is used for re-export is 4 million cubic meter which is 35.9% less than the same period last year.

Third, private companies export 70% of final wood products. Total import from private sector is 90 million cubic meter which is 23.2% less than the same period last year. State-owned companies imported 35 million cubic meter logs which is 0.7% more. Foreign companies in China imported 4 million cubic meter which is 41.5% less.

Fourth,the majority of import is from Russia and imports from New Zealand has been increased. Total log from Russia for the first half year is 77 million cubic meter which is 27.6% less than the same period last year. It is 57.7% of total importing log. Imports from New Zealand is 19 million cubic meter which is 14.1% more.

The majority of importing logs are used for re-export. The slowing demand for furniture and building materials, floors etc. has been the main reason for the slowdown of import. Many Chinese wood processing factories has been closed. 70% to 80% of engineered wood processing factories are in the state of running half capacity or stopped production completely.

While on the other hand, major suppliers to Chinese market has implemented policies that limit export of logs. Russia has increased tax to 25% and European union has implemented policies to stop illegal logging. All these efforts has increased the cost of raw material and discouraged Chinese wood processors from accumulating inventories.

The major demand from this period came from the domestic consumption. The internal demand has been boosted with the help of stimulus package both for Infrastructure building and individual consumption. However, the structure of the whole wood processing industry is still more than 70% export oriented. It takes time for Chinese companies to restructure its focus and reduce its capacity.

China's real estate has been started to bounce back during the recent months thanks to the large amount of stimulus efforts from both the central and local governments. Huge stimulus spending has been successful in stabilizing downward spiral of demand. The question is whether the real estate sector can keep its momentum to recovery or the new recovery shoots will sunk in the near future. For my view, the stimulus money has inflationary impact on the housing sector. China's stimulus efforts has been mainly focused on consumption side from both individual and state level. From individual level, consumption coupon, long holidays, tougher labor laws, employment assistance, re-education etc. have boosted demand. From state level, social security, infrastructure investment, and financial assistance to new technology and plants and inflow of oversea Chinese professionals have created new picture of future development for China. In general, most of money has been spend to strength internal demand while most troubled exported-oriented firms are encouraged to close or merge with other healthier firms. The output capacity of lumber export products has been dramatically reduced for the first half of the year.

As Chinese leaders repeatedly stressed to the rest of the world, China's stimulus efforts can't save the world out of the recession. China can only do that much to save itself. It did so. The puzzle for Canadian lumber industry is how large will be the domestic demand for lumber and logs comparing to the export sector if the export sector does not recover that soon. Not much, perhaps 20% to 30%. It will be a tough market to compete for the domestic pie. Will it be worth to pursue it? Yes! China has relatively healthy and strong financial sector and the balance sheet of the government, companies and individuals are much healthier than some of the most affluent countries. While US has been borrowing money to spend, China spent modestly in the past to keep its house in order. The potential of this domestic market for lumber and logs are worthwhile to pursue.

We are the very early state of structural global recession. To fight deflation, global leaders has poured trillions of dollars into the system. Detailed analysis of stimulus plan is shown by Brooking Institute. Despite the huge amount of money spent by each government, the efforts are still far less than needed to combat the severity of the crisis comparing to the total amount of GDP. Lumber demand from US will not recover to the previous level any time soon due to heavy indebtedness from both individual, company and state level.

The total demand of lumber will not increase anytime soon while price will increase slowly thanks to the reduced capacity in the long run. It will be good news for the few survival lumber and forestry firms, not for those who don't have the financial resources to weather the difficult times.

Doing business as usual may not work at this global recession. Bold actions and courage are needed. For most small lumber and forest firms, one of the solution is to form strategic partnership with reputable and financially healthy Chinese firms and developers. Through this partnership, small Canadian firms can have access to existing sales and distribution channel of the wood industry in China while obtaining financial support from the one of the few cash rich Chinese firms. The reward is that your firm and employees will go through the difficult time and wait for the next economic boom to reap all the profits.

For more information, please email Ying Dwyer at inquiry@chineseservices.ca

About Ying Dwyer Chinese Services

Ying Dwyer Chinese Services ( www.chineseservices.ca ) comprises China market and

business consulting, research and Chinese translation services for Canadian companies and government clients.

Wednesday, July 15, 2009

Financial assets are debt

The growth of assets needs to equal interest payment and the growth of debt. When interest payments are in default, the whole system fall apart. When creditors discover that borrowers won't have the ability to pay back interest and maturing debt, they will pull back the credit extended to borrowers.

In real world, the situation is a little more complicated with the role of financial intermediaries. The same creditor might at the same time be the borrower. For example, when pension funds invest in mortgage-backed securities, the beneficiaries of pension funds could equally possible take out mortgage loans from one of the major banks in the country. The bank then might pool large number of mortgage loans together, package them into mortgage-backed securities and sell them to pension funds.

Another example is government debt. Pensions and mutual funds invest nearly 30 percent in government debts. The government uses borrowed money to cover its revenue shortfall and spend on health care, education, social security etc. for the interest of its people. The beneficiaries of pension fund can at the same time be the borrowers.

When creditors pull back their investments, the cost of borrowing goes up and it will be more difficult for borrowers to pay back their interest and roll over their debts. The taxpayers are now both borrowers and creditors. Now the same taxpayers are suffering from both sides. The value of their investments are going down and debts are blooming.

I am not arguing that we as a society should not have the financial intermediaries to share the pie of real economic output. In fact, they are absolutely necessary to lubricate the real economic activities in complex world. The more extra savings they can turn into investment, the more people will get employed to produce something. The real argument is that how big share this financial sector should be in the whole economic pie and how large the debt level should be in terms of not threatening the borrowers' ability to pay back their interest and maturing debt.

The key to run a successful credit economy is to have a sufficient large real productive economy. That means borrowers' real income from wages has to grow at least equally with the growth of interest payment. In most developed world, the staggering real income growth came from both the lower productivity growth and greater income inequality for the last three decades. There is no short solution for quick recovery in terms of real economy.

Monday, July 13, 2009

Credit expansion and economy

In old days, banks used to be careful in watching the creditworthiness of industrial and business firms to make sure that they will pay back their loans. In modern finance world, banks need not to worry about the underlying financial strength of firms too much. They underwrite businesses and sell stocks, bonds and all kinds of different financial instruments directly back to creditors while extracting fees by servicing as intermediaries. Now they are in true sense of being intermediaries that the only goal is to achieve higher rate of return for its own shareholders. As they underwrite more and more businesses, they also use their retail channels to help the business sectors to sell these financial securities. In return, they extract fees from servicing both borrowers and lenders.

Financial firms and even the financial branch of big corporations has also been emerged to be major players in providing consumer credit during the last decades. The underlying consumption is that banks can diversify the credit risk of individuals by underwriting a huge pools of loans. They underwrite these pools of consumer debts into financial instruments and sell them back to the creditors who are willing to hold these securities. If banks or financial institutions are successful in marketing these securities and get ride of these loans and securities from their balance sheet, they will successfully transmit risk from borrowers to creditors. The only concern is that when the financial market are in turmoil, the financial intermediaries' fee business will be significantly reduced due to the lack of demand from both borrowers and creditors.

Financial instruments are in essence debts. We live in a society saturated with all different kinds of securities which assumes to meet the different needs of individual investors. However, the essence of all these securities are the same. Stocks and bonds are essentially the claims to firms' future streams of income and they vary in terms of priorities and forms of payment.We are a nation that saturated with financial advisers or investment advises that helps to manage your money. In reality, what they really want to sell are loads of debt to you. Whether you will earn the rate of return expected from these securities depends on the underlying business or consumers' ability to generate enough cash flow to pay back their debt obligations. The return of securities depends on the expected future profitability of business and expected future wage income of consumers.

There is an over-grown financial instruments (in other words debts) comparing to real productive economy. If the growth of financial products is greater than the growth of GDP (real economy), it is usually a sign of accelerating built up of debt . Productivity growth has been snagging for the last two decades. The return on securities including both stocks and bonds has been far greater than the growth of productivity and the growth of GDP. The assets of the economy including pension funds, mutual funds has been increased dramatically during the last decades while all the assets are in essence debts from other side of coin. Modern finance makes money circulates faster than ever and creates money ever faster than before out of control of banking regulatory system. In credit boom situations, accelerating amount of assets has been invested in securities which drives the rate of return higher than real productivity gain of the whole economy. Gradually, the optimistic outlook acts as a self-confirming evidence and takes on the life of its own to reach an even higher level of indebtedness for both business and consumers.

The credit boom circuit will break when it's time for consumers and business to pay back its interest and principle obligations. Some time it may starts as self-fulfilling prophecy that more and more investors start to worry about debt level. Some time it starts with the failure of business and individuals to pay back their loans. When pessimistic sentiments penetrate the market, the two forces reinforce each other and start a strong momentum to drive economy downward. That's what we saw during the last two years. Creditors pull back their investments quickly. Without reducing credit, business and consumers has been squeezed and the economy went nosedive.

Globalization also adds up complications to existing problems. Export of US financial assets has been one of the most important businesses that global financial institutions did. US has run trade deficit with the rest of the world for decades. The sales of financial instruments has been increased dramatically during the last five years.

Source: CFR

The same argument can be made to domestic market as well. Financial securities has been greatly oversold which created the credit driven boom economy for a very long period of time. It's going to take a long long time to wait for consumers to build up savings for consumption if we want to reduce instabilities built in by financial institutions today.

Credit-led consumption has a long way from recovery

The result of this credit-led consumption is that individuals, states and government are loaded with debt after decades of build-up of debts. Debts are not only the obligations for entities to pay at the debt mature date. Debt is also the future steams of income that has to be assigned to pay back for the current consumption. That means that most consumers, state and government has been spending the incomes which they might generate in the future to cover current level of consumption. We are mortgaging our future into current spending.

Suppose that government force banks and other financial institutions to continue to support the credit expansion directed at increasing consumption while wages continue to keep at suppressed level, wages earners still won't be able to pay back their loans with expected interest payment with the constraint of their limited income. Over time, creditors will lose confidence in borrowers' ability to pay back both interest and principle and they will cut the credit line eventually. If the government doesn't step in to provide credit to consumers or direct banks to do so, the consumers and wage earners will pull back their consumption and full blowup economic recession is going to take a long time to recover while consumers are saving their money to spend.

Overall, there is no short-term solution for the dilemma of whether to extend consumer credit. The root problem is income disparity which the politicians are reluctant to touch upon.

Thursday, July 2, 2009

Debt Dillema

Source:Government of British Columbia Website

As we see from the picture, most of the funding sources are from Canadian public and private sector. Among the, CPP and other pension funds takes 16 percent. Canadians financed 82 percent of its total debt.

Let's take a quick look at the biggest pension fund management firm at BC and check its asset allocation.

Source: bcIMC

From the chart, we see bond takes 27%. It's a little big surprising that mortgage-backed securities takes only 4%. ( Two years ago, the number was 30 percent or so I believe). It seems that they dramatically increased equity stakes recently comparing to the past.

We live a dilemma. On the one hand, individuals and governments are loaded with debt burden which could not possibly be increased especially in recession while all sources of revenues are shrinking. On the other hand, pension funds and private investors reply on the income from debt securities to maintain their asset value and fund the standard living of all employees.

Ironically, Canadian public and private sector has pulled the plug and abandoned debt securities during the financial stress. Housing prices were falling while funding sources were drying up. The government steped in to reduce interest rate and mortgage rate. As if only we go back to the previous debt level and fund all debts, our economy will go back on track again. The government's answer is to keep the party going. By going into more fiscal deficit, the government hopes to spend money out of recession. This recipe seemed to work pretty well in the part, so they hope it's going to work well this time. Unfortunately, the crisis is "the mother of all crisis" (Paul Volcker) and we are "at the end of credit bubble that has lasted for nearly fifty years" (George Soros). The recipe to carry on more debt may not work this time.

The synthesis perhaps is to reduce the debt level orderly over time and let the real productivity growth to take charge of its economy.

Tuesday, June 30, 2009

BC's Structual Trade Deficit

- There was a 9.0% drop in the value of BC origin exports in the first quarter of 2009 compared to the same period a year ago. Reduced exports of forest products, metallic mineral products and machinery and equipment were mainly responsible for the drop.

- The forest sector continues to struggle as exports of both solid wood (-23.4%) and pulp and paper (-26.0%) plunged in the first quarter. Exports of softwood lumber, which has traditionally been BC’s top export, have fallen 24.2% over the first three months of 2009, compared to the first quarter of 2008, and trail shipments of both coal and natural gas.

- The value of coal exports soared 81.1% in the first quarter, solely due to higher prices, as volumes shipped have actually dropped 39.3%. The global financial crisis has resulted in a significant reduction in the demand for coal and it is expected that new contract prices will drop substantially. As a result, this strong growth in the value of coal exports will likely be short-lived. Elsewhere in the energy sector, falling prices have driven the value of natural gas exports down 18.1%, despite a 5.5% increase in the quantity of gas shipped. Exports of electricity have also declined, slumping 21.9%.

- The value of metallic mineral exports fell 26.0% in the first quarter, despite a 1.8% rise in shipments of copper ores and concentrates, BC’s most significant metallic mineral export. Exports of molybdenum ores and concentrates (-48.7%) and unwrought zinc exports (-51.3%) are both well down from last year.

- Among the few bright spots in BC’s export picture were increases in shipments of agriculture and food products (+10.1%) and fish (+14.4%).

- Exports to most of BC’s major trading partners in Asia bucked the overall trend. Shipments to Mainland China (+26.5%), Hong Kong (+21.6%), Taiwan (+3.8%), Japan (+10.4%) and South Korea (+37.0%) all climbed.

- The last time BC had a trade surplus was 20 years ago, in 1988. Over the next 15 years, the deficit was fairly stable at between about $4 billion and $8 billion; however, over the last five years, the deficit has ballooned, tripling from 2003 to 2008. International trade in goods is the component driving most of this rise in the trade deficit. By 2008, the province had a trade deficit with other countries of $25 billion.

BC's export is shrinking faster than the import which is why the structual deficit had a spike recently. BC has run trade surplus with countries include the United States, the United Kingdom and most advanced economies. It has run trade deficit with China, Mexico and less developed countries. This structure means that BC's trade position will continue to deteoriate in the near future.

BC has been living a life beyond its means for a long time. The economy needs to be significantly diversified to cousion the global economic crisis.

Sunday, June 28, 2009

Pension Fund Capitalism - Globalization

Pension fund is one of major players in capital market besides private equity funds. The size of it won't be able to excuse itself from the responsibility of allocating resources efficiently to promote economic growth and other social goals.

Source: OECD Global Pension Statistics

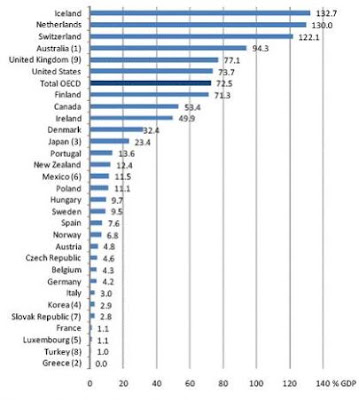

The United States had the largest pension fund market in the OECD with assets worth USD 9.7 trillion – approximately two thirds of the total OECD aggregate market. The US’ share of OECD pension fund assets was 60% in 2006. Canada has US0.7 trillion of pension funds. The more important figure is the ratio between pension assets and country's GDP. As we see from the picture, the highest asset-to-GDP ratio was Iceland's, at 132.7%. Nether land, Switz eland, Australia, the United Kingdom and the United States are next. It's not surprising to see that Ireland ran into serious pension crisis during the current financial market sharp correction.

However, the relationship between Pension fund and economic growth is far from virtuous from economic, environmental and social perspectives.

The investment process of pension fund is based on Market Efficiency Hypothesis. The sole objective of funds has been focused on achieving returns to meet its pension liabilities. However, this decision making process is irrelevant in the face of structural and market imperative. Fund investment in most cases has been used to assist the accelerating speed of globalization through investment in multinational firms. That means that local economy has been deprived of funding sources for industry growth and development. Real productive economy has been shrinking steadily while more and more cheap imports produced from multinational firms in China occupied developed world including Canada. Canada has been relying on resource industry to feed the needs of its people while local industry has been starved for money.

The downside of current pension investment is that when the boat of globalization sink, our pension sinks too. The only hope for Canada is that BRIC countries (China, Russia, Brizal and India) will pick up the demand slack left by the United States.

There are a few players for the pension fund:

Beneficiaries: employees

Pension Trustees: elected government officials

Intermediaries: Investment firms. Semi-government investment corporations.

Custodians: financial firms

Investment Products: High credit quality equities and corporate bonds, government bonds, Small portion of Alternative Investments.

Friday, June 26, 2009

Unite Nation Delegates Call for a New International Financial Order

Decrying a world economic order that had rewarded the powerful, marginalized the poor and promoted an unbridled capitalism that ignited unprecedented financial contagion, General Assembly delegates today urged swift and concerted measures to restructure international finance bodies and forge people-centred policies that addressed human security.

Ecuadorian President Rafael Correra said that the creation of a coordinating entity that could issue Special Drawing Rights would help break a monopoly in the provision of liquidity that guaranteed the dominance of the United States dollar and asymmetric decisions of the International Monetary Fund (IMF). Channelling those rights through such bodies as the Food and Agriculture Organization (FAO) would prevent the Fund from re-editing its asymmetry.

Ralph E. Gonsalves, Prime Minister of Saint Vincent and the Grenadines, also questioned why countries should be forced to borrow from those whose bad advice and reckless regulatory neglect had precipitated the crisis. The responsibility lay in the world’s unregulated financial centres, and in those who considered it their right to prescribe other peoples’ policy space. A good solution required a framework for a modern, competitive and many-sided “post-colonial” economy that was at once local, national, regional and global. To deal with the fallout, his country sought to strengthen bonds with other nations through various regional groupings.

At the same time, Heidemarie Wieczorek-Zeul, Federal Minister for Economic Cooperation and Development of Germany, pointed out that it would take an organization with the United Nations legitimacy to fully tackle the crisis. With today’s Conference, countries were strengthening the United Nations role in global economic governance and she welcomed the proposed creation of a panel of experts that included expertise from all regions.

She stressed the need for a global stimulus package that would benefit the poorest and embrace an ecological dimension. More financing was needed for development, which could be mobilized by fighting tax evasion, making greater use of instruments -- like emissions trading and “debt2health” swaps -- and having banks accept financial responsibility for the crisis. The allocation of Special Drawing Rights would provide an important foreign reserve cushion for developing countries in need.

Building on that, Reneet Kaur, Minister of State for External Affairs of India, underscored that today’s conference was the first United Nations gathering on the global financial and economic system since 1944. It was vital that the Organization’s convening power be used to hear the voice of the entire global community. At the Bretton Woods institutions, voice and quota reform needed to be accelerated. Lending by international financial institutions and multilateral development banks must also increase, and associated loan conditionalities must soften.

International financial system is falling part and financial firms are under the life support of developed nations. I am wondering how these voices will go into the ears of US politicians. Of course US won't care about the voices of these little countries accept a few big emerging countries such as China, Russia and India etc.

Climate Protection Bill

Carbon trade will give financial firms a huge potential to earn super normal rate of return in the near future while allowing the polluters continue to pollute in the western world.

The lobby -- which includes Goldman Sachs Group Inc., Morgan Stanley, Barclays Plc, JPMorgan Chase & Co. and 168 other firms -- argues that climate change can’t be solved without a profit-driven market. The organization and its members haven’t disclosed how much they earned from trading carbon permits.

China, Mexico and Greenpeace filed complaints against the carbon trade and argues that direct government tax will be more effective in protecting the environment.

It probably should be called Climate Pollution Bill.

Over the Counter Derivative

There is an article from Chris Whalen: Over-the-Counter Derivatives: Modernizing Oversight . In the article, Chris states that OTC Banking model provides super-normal return for a few dealers in the market which acts as a heavy tax burdern for other sectors of the real economy. In the economic downturn, the risks of these huge positions undertaken by the few banks and dealers are shared by all taxpayers. The compexity and oqupue of these contracts put all others players in the market an unequal level playing field. OTC Contracts has also been used by corporate executives to make up its short term profit which is essentially fraudulent.

Chris also crtisized Obama and Geinther's recent OTC reform plan, he states:

- Congress should subject all OTC contracts to The Commodity Exchange Act (CEA) and instruct the CFTC to begin the systematic review and rule making process to either conform OTC markets to minimum standards of disclosure, collateral and transparency, or require that the contracts be migrated onto organized, bilateral exchanges. It is time for the Congress to right the wrong done over a decade ago to Commissioner Brooksley Born and her colleagues at the CFTC. This wrong was committed in part by the Congress and in part by then-Treasury Secretary Larry Summers, then-Fed Chairman Alan Greenspan, and former Treasury Secretary Robert Rubin, among others, who all worked together to effectively block action that would have subjected OTC contracts to the full supervision of the CFTC.[6] [8]

- The Congress should admit that it made a mistake in 2000 by blocking CFTC regulation of OTC derivatives. The Congress should take the time to document how and why Greenspan, Rubin and Summers, and others, viciously attacked the reputation and integrity of Chairman Born and other members of the CFTC, and thereby blocked CFTC regulation of OTC derivatives. The actions of Summers, Greenspan and Rubin over a decade ago to block CFTC regulation of OTC derivatives arguably created the circumstances for the collapse of AIG as well as hundreds and hundreds of billions of dollars in losses incurred by financial institutions around the world. The Congress and the people of the United States deserve to hear the explanation of Summers, Greenspan and Rubin for the actions they took and did not take in their capacity as public officials subject to congressional oversight. [7] [9]

- I agree with the statement by Secretary Geithner last week that how and whether to combine the operations of the CFTC and the SEC is a question that needs more time and consideration than the Obama Administration has allocated for the consideration of reform for the OTC markets in 2009. I urge the Congress to move first on subjecting the OTC markets to CEA, then to take further time for hearings and fact finding to consider what other changes should occur in terms of the law and the operational structure of the SEC and CFTC.

The shadow banking system won't be gone until OTC comes under the sunshine.