Pension fund is one of major players in capital market besides private equity funds. The size of it won't be able to excuse itself from the responsibility of allocating resources efficiently to promote economic growth and other social goals.

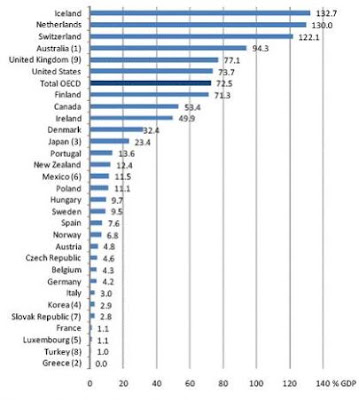

Source: OECD Global Pension Statistics

The United States had the largest pension fund market in the OECD with assets worth USD 9.7 trillion – approximately two thirds of the total OECD aggregate market. The US’ share of OECD pension fund assets was 60% in 2006. Canada has US0.7 trillion of pension funds. The more important figure is the ratio between pension assets and country's GDP. As we see from the picture, the highest asset-to-GDP ratio was Iceland's, at 132.7%. Nether land, Switz eland, Australia, the United Kingdom and the United States are next. It's not surprising to see that Ireland ran into serious pension crisis during the current financial market sharp correction.

However, the relationship between Pension fund and economic growth is far from virtuous from economic, environmental and social perspectives.

The investment process of pension fund is based on Market Efficiency Hypothesis. The sole objective of funds has been focused on achieving returns to meet its pension liabilities. However, this decision making process is irrelevant in the face of structural and market imperative. Fund investment in most cases has been used to assist the accelerating speed of globalization through investment in multinational firms. That means that local economy has been deprived of funding sources for industry growth and development. Real productive economy has been shrinking steadily while more and more cheap imports produced from multinational firms in China occupied developed world including Canada. Canada has been relying on resource industry to feed the needs of its people while local industry has been starved for money.

The downside of current pension investment is that when the boat of globalization sink, our pension sinks too. The only hope for Canada is that BRIC countries (China, Russia, Brizal and India) will pick up the demand slack left by the United States.

There are a few players for the pension fund:

Beneficiaries: employees

Pension Trustees: elected government officials

Intermediaries: Investment firms. Semi-government investment corporations.

Custodians: financial firms

Investment Products: High credit quality equities and corporate bonds, government bonds, Small portion of Alternative Investments.

No comments:

Post a Comment